does georgia have estate or inheritance tax

Seventeen states have estate taxes but Georgia is not one of those either. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

The short answer is no.

. Does Georgia have an estate tax. Florida does not have an inheritance tax. New Yorks estate tax.

There is no inheritance tax in Georgia. The exact federal rules depend on the year in which your parent died. Due to the high limit many estates are exempt from estate taxes.

Also called an estate tax or death tax an inheritance tax is a legal rate at which a state taxes the estate of a deceased person. Suppose the deceased Georgia resident left their heir a 13 million worth of an estate. The good news is that georgia does not have an inheritance tax either.

The minimum amount that an estate can be valued at without being subjected to an. First there are the federal governments tax laws. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Another states inheritance tax could still apply to Georgia residents though. 4 The federal government does not impose an inheritance tax. Inheritances that fall below these exemption amounts arent subject to the tax.

Unlike an inheritance tax New York does have an estate tax. Ad From Fisher Investments 40 years managing money and helping thousands of families. Estate Tax - FAQ.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Also called a death tax the estate tax is the final round of taxes someone pays before their property is distributed to their heirs. As of 2014 Georgia does not have an estate tax either.

As of July 2014 estates in Georgia no longer have to file estate tax returns or pay estate taxes. Delaware repealed its estate tax at the beginning of 2018. As of 2019 iowa.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Before assuming that an estate is exempt it is critically important to analyze the estate because many assets such as life. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

No georgia does not have an inheritance tax. Any deaths after July 1 2014 fall under these rules. Georgia has no inheritance tax.

Maryland is the only state to impose both. For 2017 the Federal Estate and Gift Tax Rate is 40. As with the exemptions there is always the possibility that Congress will change.

In this case 940000 would be subject to a Federal Estate. Provisions of OCGA. According to the.

Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. Impose estate taxes and six impose inheritance taxes. A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the.

This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption exceeds 549 million the amount above 549 million will be subject to a 40 tax. A federal estate tax is in effect as of 2021 but the exemption is significant. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current fairly high.

Only a few states collect their own estate or inheritance tax. For 2020 the estate tax exemption is set. As of 2014 Georgia does not have an estate tax either.

There is a minimum amount that the estate can be valued at that wont be taxedonce the estates value goes above that amount the entire estate is subject to the tax. As of July 1st 2014 OCGA. The federal estate tax exemption is 1170 million in 2021 going up to 1206.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. Any deaths after July 1 2014 fall under these rules. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Twelve states and Washington DC. Georgia estate tax and georgia inheritance tax the state of georgia eliminated its estate tax effective july 1 2014 and has no inheritance tax.

However this privilege only applies to estates whose decedents passed away before January 1 st 2005. The law does not forgive any tax liabilities interest or penalties associated with an estate whose owner. Even though there is no state estate tax in Georgia you may still owe money to the federal government.

However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206 million. In this case 940000 would be subject to a Federal Estate. Georgia Inheritance Tax and Gift Tax.

Only 11 states do have one enacted. 117 million increasing to 1206 million for deaths that occur in 2022. However the federal exemption equivalent was 3500000 for 2009 5000000 for 2010.

After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. Georgians are only accountable for federally-mandated estate taxes in cases in which the decedent and their. Georgia does not have any inheritance tax or estate tax for 2012.

Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

Georgia law is similar to federal law. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. Elimination of estate taxes and returns.

No Georgia does not have an inheritance tax. Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes. Prior taxable years not applicable.

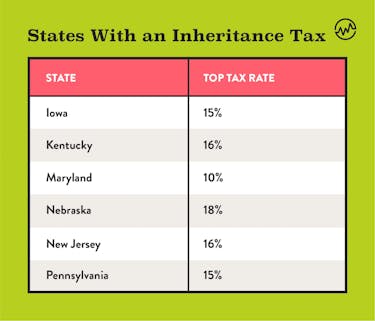

You may still have to file a gift tax return. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

There are not any estate or inheritance taxes in the state of Texas. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. As of July 1 2014 Georgia does not have an estate tax either.

But in Florida the inheritance tax rate is zero. 48-12-1 was added to read as follows. States Without Death Taxes.

No Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Nevertheless you may have to pay the estate tax levied by the federal government. However other stipulations might mean youll still get taxed on an inheritance.

Even with this welcome benefit there are some returns that must be filed on behalf of the decedent and their estate such as.

401 K Inheritance Tax Rules Estate Planning

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax In The Uk Offshore Citizen

State Death Tax Is A Killer The Heritage Foundation

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

State Estate And Inheritance Taxes Itep

What You Need To Know About Georgia Inheritance Tax

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Is Your Inheritance Considered Taxable Income H R Block

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit